46+ can i deduct mortgage interest on second home

Discover How HR Block Makes It Easier to File Your Way. Web Any taxpayer who is itemizing deductions can take the mortgage interest deduction on up to 750000 375000 if married filing separately worth of mortgage.

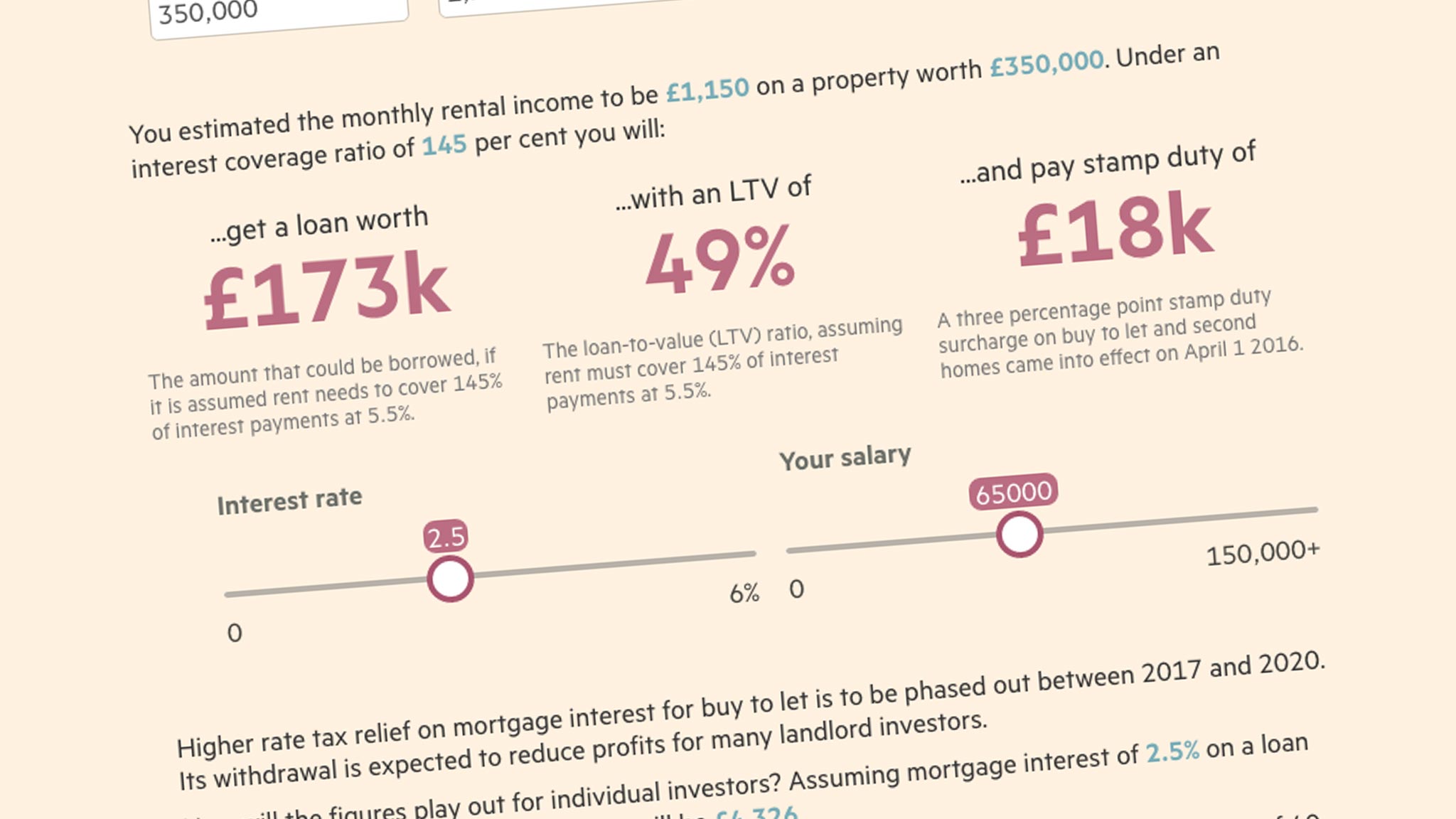

Is Your Buy To Let Investment Worth It Use This Calculator To See If Your Sums Add Up

Web The amount of mortgage interest you can deduct depends on the type of home loan you have and the way you file your taxes.

. Start Today to File Your Return with HR Block. It permits you to deduct the interest on up to 750000 you borrow to buy or build a new main. Web Up to 25 cash back The home mortgage deduction is one of the most popular deductions.

Ad Shortening your term could save you money over the life of your loan. Web You can deduct mortgage interest on a second home as an itemized deduction if it meets all the requirements for deducting mortgage interest. Web You can deduct property taxes on your second home too.

Ad Learn How Simple Filing Taxes Can Be. Web Yes your deduction is generally limited if all mortgages used to buy construct or improve your first home and second home if applicable total more than. In fact unlike the mortgage interest rule you can deduct property taxes paid on any number of homes.

File Online or In-Person Today. Web The short answer is. Lock In Lower Monthly Payments When You Refinance Your Home Mortgage.

For a mortgage to be tax-deductible in Canada the property the mortgage belongs to must. Ad Usafacts Is a Non - Partisan Non - Partisan Source That Allows You to Stay Informed. Secured by that home.

Web As noted in general you can deduct the mortgage interest you paid during the tax year on the first 750000 375000 if married filing separately of your. If you are single or married and. It all depends on how the property is used.

Web So if you have one mortgage for 500000 on your main residence and another mortgage for 400000 on your vacation home you cant deduct the interest. I took out a home equity loan secured by my main home to pay off personal debts. Web Deducting mortgage interest on second homes If you have two homes you can still deduct the mortgage interest on your federal taxes on a second home.

Web Up to 96 cash back Used to buy build or improve your main or second home and. You can fully deduct home mortgage interest you pay on acquisition. 13 1987 the IRS lets you deduct the interest payments that accrue on a maximum of 100000 in loan balances or the actual equity.

Web The mortgage interest deduction is a tax incentive for homeowners. Web Yes you can include the mortgage interest and property taxes from both of your homes. This itemized deduction allows homeowners to subtract mortgage interest from their.

Web Your combined total home equity debt on your second and first home cannot exceed 100000 if you are single or married filing jointly or 50000 if married filing separately. Web If your total principal amount outstanding is 750000 375000 if married filing separately or less you can deduct the full amount of interest paid on all mortgages for a main or. However the deduction for mortgage interest starts to be limited at either.

As long as you dont rent out a second home for more than 14 days each year you can deduct the mortgage interest you pay on it. Web Is interest on a home equity line of credit deductible as a second mortgage. Web Provided you took the loan out after Oct.

Liability Insurance Regimes In Eu Construction Sector By Huib Korevaar Issuu

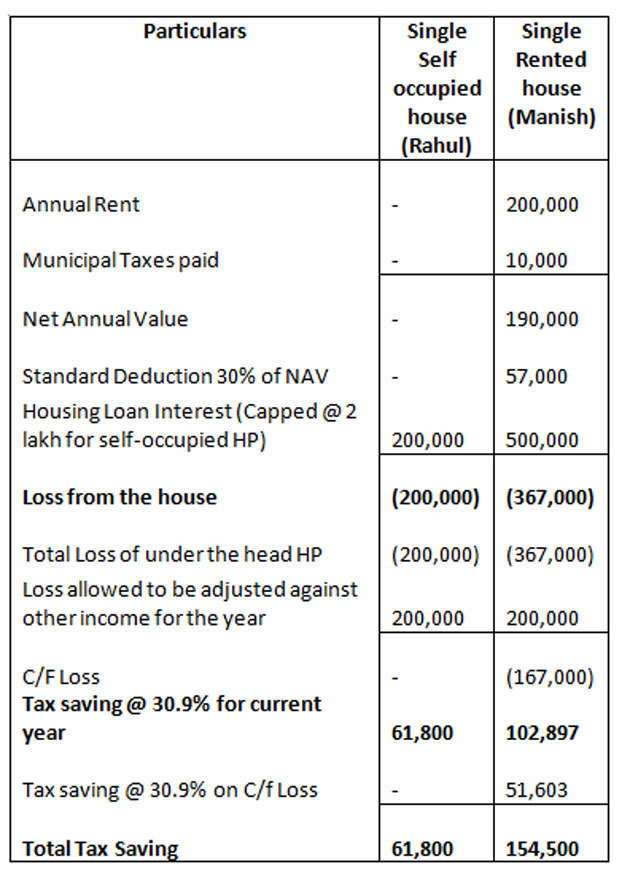

What Are The Income Tax Benefits On Second Home Loan In India

Home Mortgage Interest Deduction Deducting Home Mortgage Interest

News

Deduct Mortgage Interest On Second Home

Rent Adjustment Commission California Tenant Law

Primary Residence Value As A Percentage Of Net Worth Guide

Home Loan And Tax Benefits On Second Home

Calameo The Islander November 7 2017

Deduct Mortgage Interest On Second Home

Home Mortgage Loan Interest Payments Points Deduction

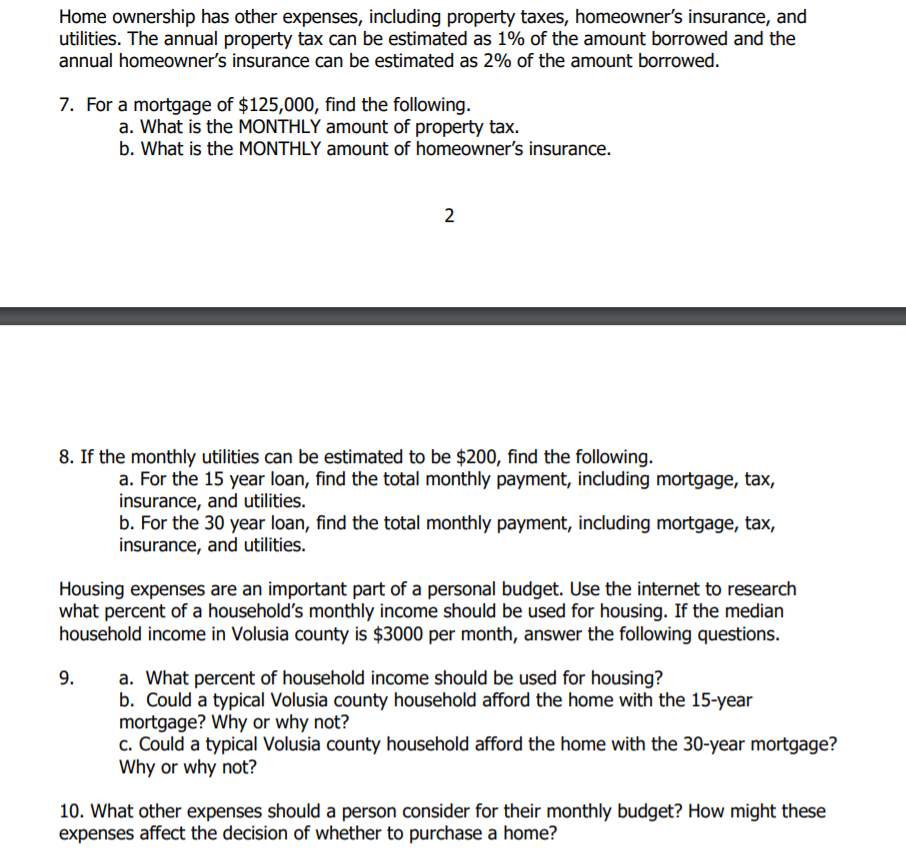

Solved Home Ownership Has Other Expenses Including Property Chegg Com

Second Home Tax Deductions Tax Tips For Homeowners

Frequently Asked Questions For The Deduction For Home Loan Interest In Hong Kong Company Formation Trademark Registration Tax Service Hong Kong Cpa Kaizen

Can You Deduct Mortgage Interest On A Second Home Moneytips

Budget 2018 Budget 2018 Needs To Revise Cap On Home Loan Interest Tax Break For Self Occupied Property The Economic Times

Primary Residence Value As A Percentage Of Net Worth Guide